Dear Sirs,

Our partners include dozens of foreign and Russian banks, several consulting and development companies. We work with the best specialists in the Russian fintech industry. We create businesses and connect acquiring for Bitcoin and other cryptocurrencies. Contact us!Benefits of Accepting Payments with Ecommerce Payments:

• VISA and Mastercard cards

• E-money

• Mobile payments

• Bank transfers

• Minimal fees

• 50+ payment methods

• Quick and easy integration

• Online sales automation

• Working with HIGHRISK projects

• Implementation of complex solutions

• A wide range of ancillary services

• Bespoke approach

Accepting Payments on Your Website

Domestic businesses often encounter numerous challenges when trying to accept payments on their websites, a task easily accomplished by any European company. There are several reasons for this: firstly, domestic payment providers charge exorbitant fees for electronic payments compared to Europe. Secondly, Russian limited liability companies cannot directly connect to European payment processors (Europeans only work with other Europeans). Thirdly, payment data is always reported to the tax authorities, depriving Russian companies of the tax planning opportunities widely available to online businesses.

In this situation, some Moscow-based firms of the “old school,” specialising in offshore services for ordinary companies, offer to connect foreign payment processing for 6,000-8,000 euros. However, this acquiring service is often offered without the necessary experience or understanding of the client’s needs. The following table illustrates the current state of affairs in the field of electronic payment acceptance:

Analysing this data, it is easy to understand that a Russian businessman who needs to accept payments online is in a situation where no payment acceptance system is suitable.

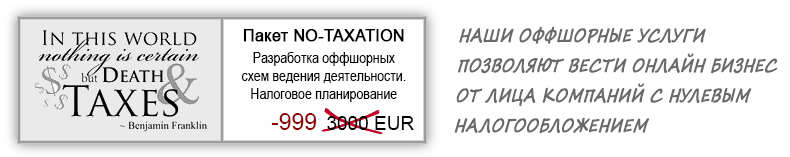

Nevertheless, a solution exists. In this case, it may consist of the simultaneous use of technologies for withdrawing funds to foreign accounts, creating structures of legal entities and using the peculiarities of online business and offshore taxation. Plans for the simultaneous use of these technologies are also called “offshore schemes”.

Electronic Payments

Additional Factors

Accepting payments online using such schemes allows to reduce the total costs (including taxes) of most online businesses to 2-3%. However, it is not that simple. Connecting a payment gateway is not enough – Internet companies need to take measures to minimise losses arising from fraudulent activities (Fraud filtration) and payment reversals (Chargebacks). For this purpose, various Fraud filtration services, customer support services and some other measures are used. Such services in various forms and at various prices are also provided by payment providers.

From the above, we can conclude – in order to optimally organise the acceptance of payments on the website, it is necessary to have significant experience and possess up-to-date information about the global electronic payments market. It is because of the complexity of the issue that a comprehensive service called “Simple Internet Payments” was developed.

This service includes assistance at every stage of connection – from developing a payment processing scheme and registering offshore legal entities to setting up Fraud filters for individual client categories. Within the framework of this service, each of our clients is offered an individual scheme, depending on the specifics of their business model and the degree of “risk” of the business. Here are examples of choosing a payment acceptance system depending on the level of “risk”.

Payment Gateway System

Ecommerce Payments Algorithms

As a rule, “low-risk” businesses are most profitable to serve in European countries, such as Cyprus or Denmark. Typical difficulties in connecting such companies are the lack of offer agreements and English versions of the main pages of the site. Also, providers often explain the refusal by the incomprehensibility of the business model or copyright infringement on certain content. Therefore, we prepare our clients in advance for contact with a partner bank or provider – we help with English versions of the necessary documents and the legal organization of the site, and also provide the necessary advice to business owners. With our help, in 100% of cases, low-risk businesses are successfully connected to European processing.

The system for accepting payments on the site does not have to be European – for each type of business, you should choose your own connection methods. For example, such a problematic and licensed topic in Europe as the trade in pharmaceuticals is perfectly served in Egypt. And adult sites, which in the “Western world” require agreements with models, do not experience any difficulties in Kuala Lumpur and Vietnam. Mauritian and Seychelles processing are specialized in betting and gambling.

| Type of Financial Institution |

Classic Example |

Can Connect a Russian LLC |

Commission | Ease of Connection | Convenience for the Buyer | Withdrawal Fee | Data Hidden from the Russian Tax Service |

| Domestic Banks | Sberbank, Alfa-Bank |

V | 2..4% | Very Difficult | 🙁 | 0.1..1% | X |

| Domestic Processors | Robokassa, Assist |

V | 2..4% | Medium | 🙂 | 0.5..1.5% | X |

| Domestic Payment Systems | QIWI, WebMoney |

V | 1..2% system + 0.5..2% bank |

Easy | :\ | 1..2% | X |

| Foreign Banks and Processors | Barclays bank, FirstData, JCC | X | 0.5..1.5% | Very Difficult | :\ | 0.1..0.5% | Depends on Jurisdiction |

| Foreign Payment Systems | Paypal, MoneyBrookers | X | 1..2% system + 0.5..1% bank |

Medium | 🙂 | 2..3% | Depends on Jurisdiction |

| Offshore Payment Systems | iPayDNA | X | 4..6% | Difficult | 🙂 | 0.1..0.5% | V |

Our services:

■ Acceptance of VISA / MasterCard payments via our own processing

■ Assistance in organising activities using offshore schemes

■ Connection of third-party foreign payment systems and banks

■ Services for minimising the level of chargebacks and protection against fraudsters

■ Consulting services on the integration of billing (payment) servers of banks in offshore jurisdictions.

| Rates for connecting partner payment systems (connection to our system is always free) |

For trading virtual goods worldwide | For trading physical goods in the Russian Federation | For trading physical goods in EU countries |

| Simple connection of a website to a partner payment system or bank: • Broad distribution of requests to processors and banks (over 50 providers); • Selection of offers with the lowest commission; • Preparation of the initial set of documents; • Conducting negotiations with counterparties; • Consulting on integration with payment systems. |

299 € payment gateway setup |

370 € payment gateway setup |

199 ~ 970 € depending on the initial data |

| Aggregated solution for minimizing commissions and taxation with the maximum number of payment options: • Broad distribution of requests to partner processors and banks (over 50 providers); • Implementation of a tax minimization scheme; • Creation of legal entities (1-4 depending on the complexity of the scheme); • Finding payment solutions with minimal commissions and maximum choice of options; • Preparation of initial documentation; • Conducting negotiations with counterparties; • Consulting on integration with payment systems. |

1770 € one legal entity, account, processing / bank |

~3700 € 2-3 legal entities, accounts, processing / bank + 999 € tax planning services (development of activity scheme) |

2499 € one legal entity, account, processing / bank, complex connection |

| Optional: • Preparation of agreements between holding companies and offer agreements with end payers; • Protection of intellectual property rights for software products, domain names, etc.; • Obtaining licenses for conducting activities; • Opening accounts in offshore banks. |

According to standard rates or by agreement |

||

Connecting to the payment gateway with our help is possible through one of two scenarios:

Option 1:

“Easy Online Payment Integration”

* It is assumed that legal entities already exist, accounts are open, and sales statistics are available.

1. In telephone conversations, correspondence or by filling out an application form, the customer communicates their preferences for the required payment options and provides contact details. Our managers determine possible options for cooperation.

2. Based on the data from the application form and the customer’s wishes, either the connection is established through our Ecommerce Payments processing, or a selection of the most suitable partner payment providers is created. In the second case, the information is sent to these payment systems and banks.

3. It usually takes 2-3 days to obtain preliminary approval both in our processing and in any third-party processing. After that, as a rule, the customer is advised to provide additional information about the business and, if necessary, make changes to the website to comply with the requirements of card regulators.

4. The customer is made preliminary offers on existing connection options with specific figures for commissions, terms and amounts of “hold” and a full application form is sent. If the connection is made through Ecommerce Payments, the data for integration is sent immediately.

5. It usually takes 1-2 weeks to process a full application depending on the scheme of work.

6. If the connection is made through us, then an agreement is concluded, and payments are accepted. If through a third-party provider, then our services are paid for and the coordinates of the connecting payment system or bank are transferred for concluding an agreement and carrying out system integration.

7. The connection is complete.

Second option:

«Offshore scheme + Payment processing»

In this case, a comprehensive assessment of the client’s needs is carried out. Negotiations are mandatory, an action plan is developed. The detailed procedure for interaction when creating an offshore business is described in the corresponding article on the creation of offshore schemes. With such cooperation, the “Simple connection” algorithm described above is also present, but it is only a part of the work carried out within the framework of the entire project.

If you need to organise the acceptance of payments on the website of your company, then the best way to do this is to contact us. The service can be provided to companies from any CIS country, without a personal meeting, including on the basis of an email request and minimal telephone conversations. We are always glad to hear from you, please contact us.

Alexey Zarin

Moscow, 2012